Every day, it seems the sky falls just a little more.

Thousands of associates and law firm staff members have been let go in the past six months - a purge that many current law firm leaders say they believe is necessary to steady their ships and achieve a way forward.

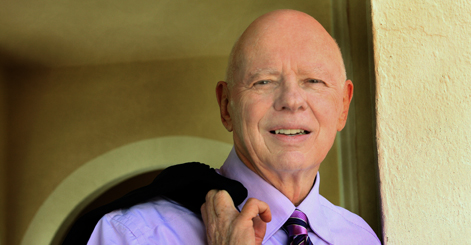

After reading dozens upon dozens of "we're very sorry" memos, we turned to one of the nation's most esteemed law firm management experts, Ralph Savarese of McMorrow Savarese, who has counseled dozens of law firms on mergers, strategy and survival.

George Santayana penned "Those who cannot remember the past are condemned to repeat it." What Savarese brings is an acute understanding of the past. As a trial attorney he rose through the ranks at what was then Howrey & Simon, a 130-attorney Washington, D.C. firm that found itself in the unenviable position of specializing in antitrust law when Ronald Reagan was elected to office, effectively ending antitrust enforcement.

Savarese became chairman and managing partner of the firm in 1983 and held that position until 2001, when he joined Bobbie McMorrow to establish one of the nation's most elite strategic advice boutiques for the legal profession.

Highly regarded for his expertise in market and law firm economics, Savarese is known to his clients for no-bullshit, no excuses and an exquisite eye for a financial bottom line that allows no prevarication. He and I have talked on and off for the past year about the state of the legal industry, and through its ebbs and, well, mostly ebbs, he has expressed mounting concern that firms are in denial about the fundamental changes that will be necessary as the current downturn imposes itself on big law firms throughout the country.

This particular discussion took place in the fortnight of the Big Axes - one in which thousands of law firm associates and staff were let go by the likes of Paul Hastings; Chadbourne & Parke; Venable; White & Case; Morgan Lewis; K&L Gates; Latham; and Orrick.

VULNERABILITY UNIQUE IN TIME AND DEGREE

Lawdragon: What the hell is going on in the law firm industry?

Ralph Savarese: There's never been a time, certainly in my experience when law firms have been more vulnerable than they are today. Think Inflection Point. Think Game Changer. Think the Berlin Wall coming down.You don't want the prosperity of the last decade to fool you into thinking that this downturn is one of those normal cyclical events. Nothing normal about this.

Of course, law firms will not all be affected in the same way. In many cases, however, I believe survival is the issue. Leadership and partnership solidarity will be tested like never before.

LD: How does this compare to earlier economic slumps?

RS: Look, I started practicing law in the '60s, so I remember several downturns. Most people would agree that this current downturn is worse than the Tech Bubble of 2001. You want to remember that several of the Silicon Valley firms nearly disappeared. Don't listen to anyone who tries to tell you differently. And everyone would agree that the current situation is worse than the recessions of the 90s, the 80s and the 70s. Only the Great Depression was worse.

LD: What's your economic basis for thinking this crisis is worse than those that preceded it for the legal profession?

RS: The starting point is the macro economy and what's going on at large as it affects U.S. and global consumers of legal services. Recently, it was reported that the gross domestic product for the U.S. was down 6.2% for the 4th quarter of 2008. Prior to getting that data, most experts had forecast GDP would be down in the 3 to 4% range. Now the decline in GDP of "only" 2 to 3% points higher may seem really small. But that's not the way to look at it. Those 2 additional points on top of the projected 4 means they were off 50%. If you review the forecasts of the last 12 months, almost all of them have underestimated the magnitude of this downturn.

It just may be that the models being used are really not designed for the volatility of these times. The forecasting professionals have not been able to accurately forecast even one quarter ahead.

DEMAND HAS NOT BEEN AS ROBUST AS MANY THINK

RS: And by the way, demand for legal services need not fall precipitously to reach the negative side of zero. The last seven years have been characterized by substantial increases in law firm revenue and profit, not as a result of robust increases in demand but as a result of billing rate increases, restraint on promotions to equity partner and the acquisition of revenue through the acquisition of lateral partner talent.

LD: What else are you hearing from your clients that is causing you concern that law firms are applying band-aids where triage may be necessary?

RS: We hear from our clients, corporate counsel, others throughout the industry all kinds of anecdotal information pointing in one direction: severe cutbacks by clients. Stories about cutting budgets for outside counsel by 10% or more.

Look, with minor exceptions, the reality is that M&A work is dead. Real estate work is non-existent. Putting aside bankruptcy, in every historic bust, litigation was the work that saved the day. But when we talk to law firms about litigation even in the patent world, I'm being told clients are cutting back. They've decided to cut back on the volume of prosecution work and are postponing any litigation they can. You can bring a lawsuit and prevail at trial but still not be assured of winning because today you don't know whether you will be able to collect on the judgment.

One of our clients - a leading and successful IP boutique - told me that one of their very best long-term patent clients has decided to put off all their outside legal work except what is absolutely necessary to preserve the asset value of the corporation.

Let me summarize this way: Clients are pushing the reset button. They are insisting on smaller teams for their litigation and corporate work. We've heard a lot about this in the last few weeks. Clients are redesigning the value paradigm.

Much of the work that went outside they no longer deem to be of the same value. Work once viewed as essential is now viewed as elective. Work once viewed as high in value is no longer needed or is viewed as much less in value and warranting a much lower price. Commoditization is spreading to more and more work. It may well retreat some in the long run but in the short run it will operate with force.

MANAGING RISK BECOMES PARAMOUNT

LD: What should firms do?

RS: Managing risk becomes paramount. Declines in revenue will not necessarily be gradual. Monitor demand (billable time and new matter intake) and rate realization throughout the month. Don't simply wait to review the monthly reports that arrive a week after the month has ended.

In my view it is absolutely critical that law firms make a totally objective self- assessment of their financial exposure under alternative but realistic scenarios. Some law firms are corrupting that assessment by approaching it with a mind-set aimed at minimizing the cuts and changes that are necessary. They agonize over how their reputation will be affected, what's fair and not fair, and argue to let's wait and see what happens.

You defer at your peril. Plans to minimize the financial impact of the current downturn take time to formulate, time to gain partnership support and time to execute. All too long to sit back and wait and see.

Don't confuse solutions and remedies with an assessment of your financial exposure.

Solutions and remedies must correspond to the nature and scope of the firm's financial exposure. Survival is at stake. You can't start with a discussion of what kinds of remedies and dosages are palatable. Not in this environment. Not much of what will be necessary will be palatable.

It is my view that just as the country and the experts have tended to fail to appreciate the degree of this downturn, law firms will tend to do the same thing - not all but many.

LD: How big of a role is fear playing in this market?

RS: If you watch the way in which CEOs of large companies deal with the press and public, you will notice they're all afraid of spooking their investors by telling them the worst case scenario. They tend to understate what might happen. They fear the reaction of their constituents and the press, or are just fearful generally.

In the long run, unless the law firm leaders are realistic and communicate the reality to their partners, they are not going to formulate the right kind of solutions, nor recruit the support they will need to take the necessary action.

And law firms are particularly vulnerable. As soon as the key partners in the law firms start thinking that management is unclear about what's going on and doesn't have a handle on this recession, the partners begin losing confidence, they start talking to headhunters, some move elsewhere and then you find yourself flirting with the death spiral. Thelen, Brobeck, we've all seen it.

So to hide and not confront the reality is a huge mistake.

REVENUE WILL LIKELY SHRINK IN A NUMBER OF WAYS

LD: Well, let's talk about how the revenue will be affected.

RS: There are four ways law firm revenue will likely be negatively impacted. First, by a contraction of work - declines in demand for outside legal services. This will manifest itself in two different ways. Clients will simply have less needs and thus less work to give law firms. And where they do have needs for outside help, they will insist on much smaller teams than they were willing to accept previously.

Second, there is extreme pressure on price. Whereas in the last 7 to 10 years, law firms have been able to increase billing rates and capture most of the increase, in these times it would be a mistake to assume you can do that. Law firms need to assume a decline in their average realized billing rate. Companies are under cost-reducing pressures exceeding by far anything we have seen in at least the last 50 years. This will manifest itself in both declines in demand and billing rates.

Third, the collectability of revenue will deteriorate. Often, law firms find accounts receivable write offs at around 1 percent of revenue. For sure in this climate, collectability will go down, maybe another point or two. And fourth, as many law firms experienced at the end of '08, there will be delays in collections as the collection cycle lengthens. Also, some firms have probably pushed year-end '08 collections too hard and won't be able to replicate the collection results at the end of '09.

THE INSIDIOUS LEVERAGE MULTIPLIER

LD: So how will the pressures on the revenue side impact the bottom line?

RS: This is one of the most critical points that I see law firm leaders failing to understand - leverage and the insidious way it operates in volatile economic times. The industry has typically thought of leverage in terms of head count. How many equity partners does a firm have versus other lawyer personnel or all lawyers in the firm. While that's useful in terms of understanding the relative size and importance of the different professional staffing categories of a firm, it's of no use when assessing how declines in revenue will affect income for equity partners.

Let's look at a firm like Latham & Watkins, for example. Their equity partners represent about 25 percent of their total number of lawyers, not an uncommon percentage. That yields a 4:1 ratio of total lawyers to equity partners - a fairly high leverage number. But they also have high margins. The net income for equity partners represents 50% of gross revenue, in other words, a 50% margin, a ratio of 2:1 between gross revenue and net income.

The leverage effect of declining revenue on the bottom line for equity partners is therefore really a function of profit margin, not head count - the usual way of measuring leverage. In Latham's case, what it means is that with every one percent decline in gross revenue, their net income for equity partners goes down not by a multiple of 4 but a multiple of 2 - gross revenue divided by equity partner net income or 100% divided by the margin of 50%.

So what's critical here is the firm's Leverage Multiplier calculated properly. If you happen to have a 25% margin and you anticipate a decline in revenue of 5%, the Leverage Multiplier is 4 and the equity partners are facing a decline of 20% in compensation before any consideration of mitigating cost-reducing actions. If you have a margin of 33% and you anticipate a decline in revenue of 10%, the Leverage Multiplier is 3 and the equity partners are facing a hit to compensation of 30%.

Ironically, the law firms with the lower margins will in general not be as adversely affected by demand declines as the firms with the higher margins provided they implement timely and comprehensive downsizing. This is so because the profit contribution of income partners and associates at the lower margin firms is typically less. They will therefore lose less profit as a result of any downsizing.

Not surprisingly, downsizing is an effective way of dealing with projected long-term declines in demand. While it won't totally eliminate the Leverage Multiplier effects and while the benefits are initially blunted by the costs of implementation, it can in the long run help a whole lot. Billing rate declines, however, are a different matter. Downsizing cannot help in that case.