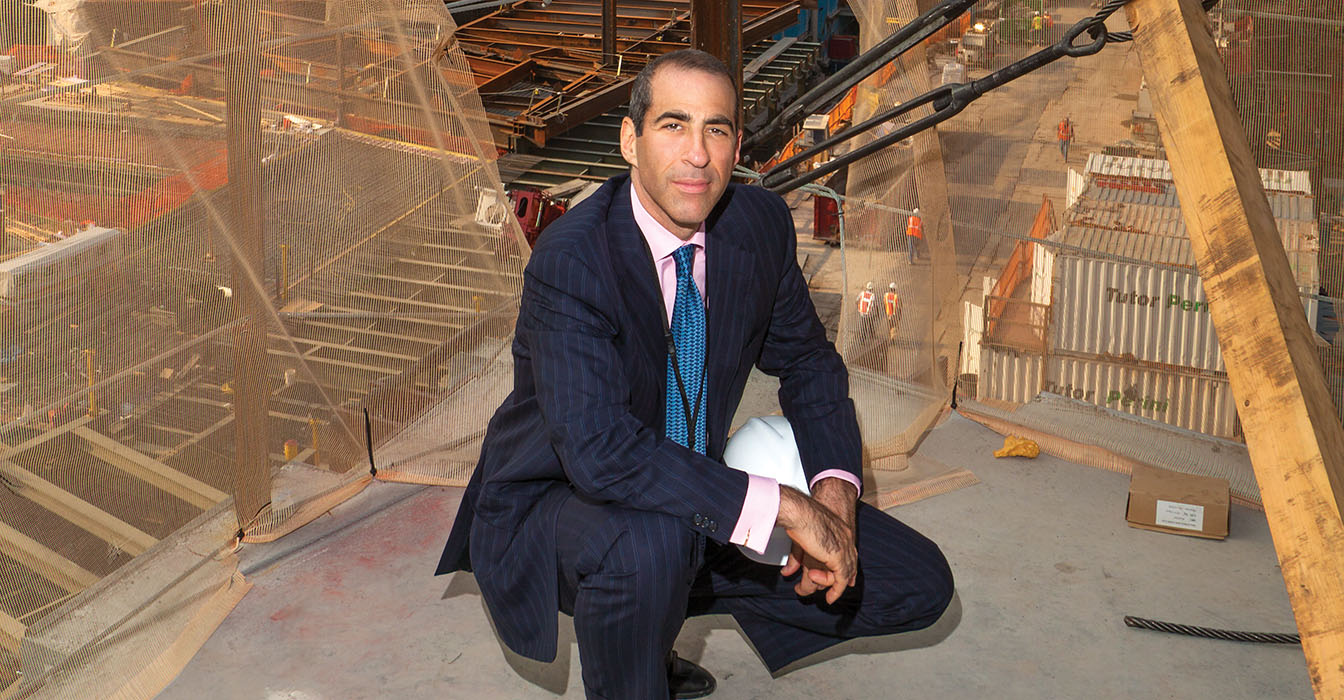

It’s difficult to find a firm that surpasses the intellectual firepower of Wachtell Lipton. Case in point: Dealmaker Adam Emmerich, who has handled more than $500 billion in deals, including Covidien in its $42.9B acquisition by Medtronic; Deutsche Telekom and T-Mobile US in the $30B combination of T-Mobile and MetroPCS (following the frustrated $39B sale of T-Mobile to AT&T, in which the break fee alone was $6B); and the board of Wyeth in its $68B acquisition by Pfizer.

He brings a deeply philosophical and well-read thoughtfulness to his dealmaking, moving easily from Piketty to Perchick and from super investor Warren Buffett to Superman. But as with all Wachtell dealmakers, it’s really always the deal now, isn’t it?

As the summer of inversions kicked off, his writing in the Harvard corporate law blog was quoted by Andrew Ross Sorkin in the New York Times, bringing Emmerich a heightened measure of renown. Jim Stewart also tipped his hat to Emmerich in the Times when Deutsche Telekom collected the AT&T break fee.

Lawdragon: You’ve been focused on so-called “inversions” recently, including your work for Covidien. How do you square that with the hullabaloo about U.S. companies trying to escape their fair tax share?

Adam Emmerich: This subject drives me crazy. The idea that non-U.S. income should be subject to U.S. income tax if you bring it back to the U.S. – and at the world’s highest rate – just defies common sense. Microeconomics is not some right-wing belief system where if you disagree with the consequences you can ignore the incentive effects of a tax system just because you don’t like them.

LD: Is the debate mostly a political one?

AE: It’s one of these populist, demonizing issues, which is unfounded. I was just reading a piece by Harry Stein, whose father wrote Fiddler on the Roof. And the son became right wing, and had lots of fights with his liberal father. And Harry quoted a line by Perchick, one of Tevye’s sons-in-law, who says, “In this world, it’s the rich who are the criminals. Someday their wealth will be ours.” To which Tevye responds, “That would be nice. If they would agree, I would agree.”

And that’s the point – it’s magical thinking. On inversions, critics’ hearts are in the right place – people should be proud to be American – but they’re wrong to tar companies that invert with a lack of commitment to the U.S., and wrong to think that a foreign incorporation deprives the U.S. of a fair shot at taxing actual U.S. corporate income. They’re painting something in black and white terms that really isn’t.

LD: You’re so well read. What did you read growing up?

AE: A lot of Superman comic books. I was much more DC Comics than Marvel.

LD: And what are you reading now?

AE: I read a lot of magazines, history, social science. I just read a piece in The New Yorker about the history of the office – the changing conceptualizations of what the workplace was like over the last 200 years. It said the latest evolution of the office is an empty room with an electrical outlet and a sign that says “Free WiFi.” We haven’t quite got there yet, and while we’re all certainly plugged in 24x7, along with the rest of the world, the firm benefits hugely by all of us being together in the same office, sparking creativity and esprit de corps.

LD: Why did you choose Wachtell? You clerked at the New York DA’s office and at the Solicitor General’s. Did you ever consider another firm?

AE: I went to law school at the University of Chicago, which is on the quarter system, so we began quite late. I was working in the DA’s office my first summer, before the big recruiting season. So before going back to school I contacted Wachtell, said I was in New York, and perhaps it might be convenient for us both if I just visit now.

LD: So you never interviewed on campus or with another firm?

AE: For better or worse, no. I liked Wachtell because it was very different from other firms; a small group of people practicing at the highest level. Over the years, Wachtell has become even better known and more sought after by the most accomplished law students. On the other hand, given the way things have evolved, Wachtell is even more different today. We used to be less leveraged than most, but relatively are even more less so, so to speak. We used to be highly specialized and, again, while so many firms are bigger than ever, many groups of partners that come and go, we haven’t changed at all.

LD: Whom do you consider your mentor?

AE: It’s hard to escape mentioning Marty Lipton. Wachtell Lipton and our corporate practice is very much something Marty created not only through his brilliance and example, but by fostering a true partnership of real meritocracy and real teamwork. There’s no one I’ve spent more time learning from, as mentor, partner and friend. Anybody you see doing a good job, you appreciate what their qualities are. Marty has great qualities as a lawyer; he’s intense, focused, determined, creative. He will always give 110 percent for the client in solving the client’s problem. And we’ve all learned by watching how the people at the firm behave from the first moment we got here. People who join us today will see us behaving that same way, and the culture will continue.